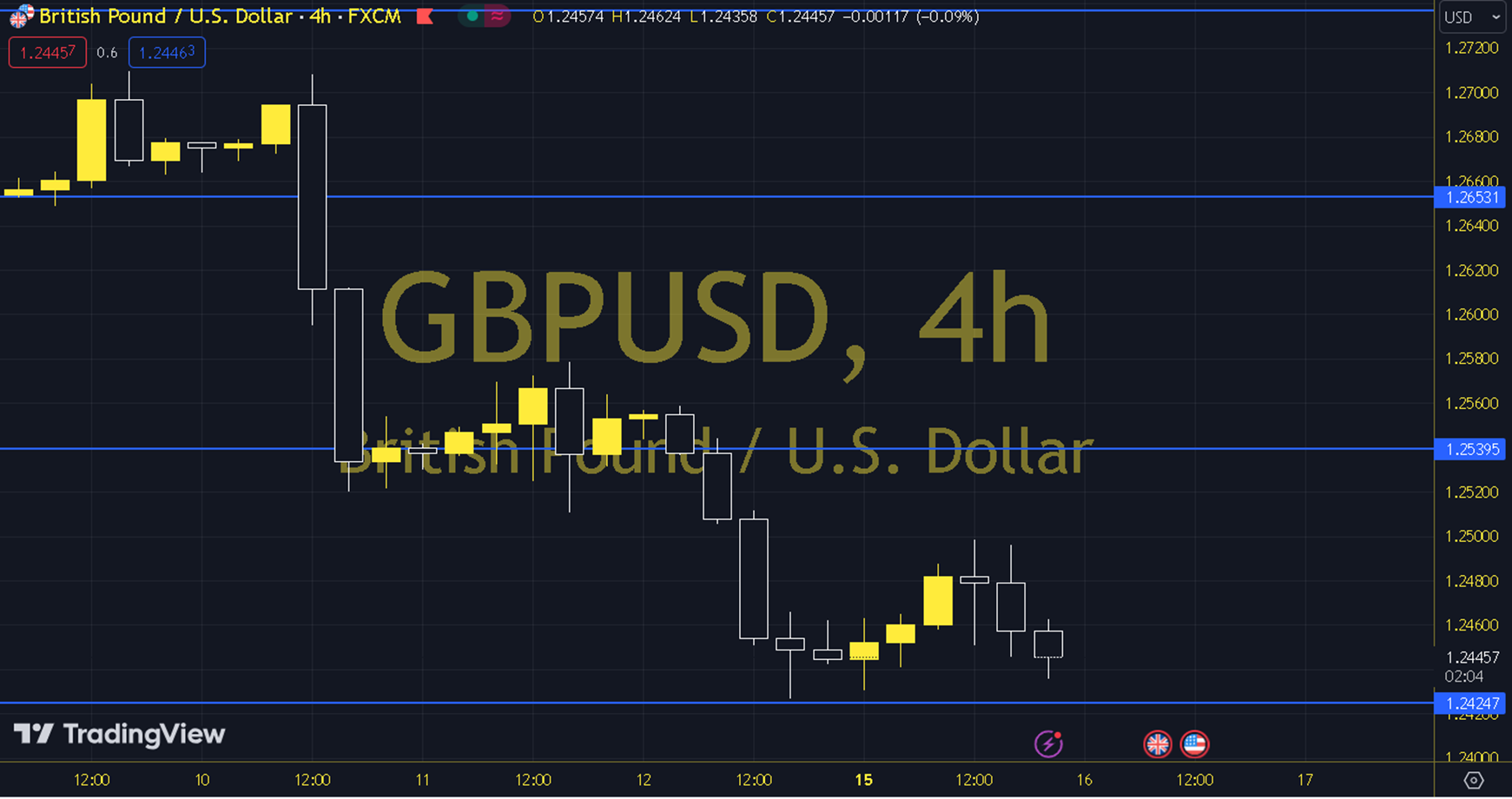

GBPUSD

Following last week's CPI, the upward trend in the Classic Dollar Index and US 10-year bond interest rates continues with the Retail Sales data coming in above expectations yesterday. Especially in an environment where the Fed can make a maximum of 2 interest rate cuts by the end of the year and the first interest rate cut has almost been postponed to the September meeting, and the ECB's June thinking remains at the forefront, the Dollar Index's stance above 105.50 keeps GBPUSD under pressure. Following yesterday's Retail Sales data, all eyes are on the messages that Fed Chair Powell and BoE Chair Bailey will give in light of the latest economic indicators, which may be important. The 1.2434 level can be monitored in intraday upward movements. If this level is exceeded, the resistances of 1.2448, 1.2465 and 1.2478 may become important. In possible pullbacks, 1.2418, 1.2404 and 1.2387 will be monitored as support levels. Support: 1.2404 – 1.2387 Resistance: 1.2465 – 1.2478