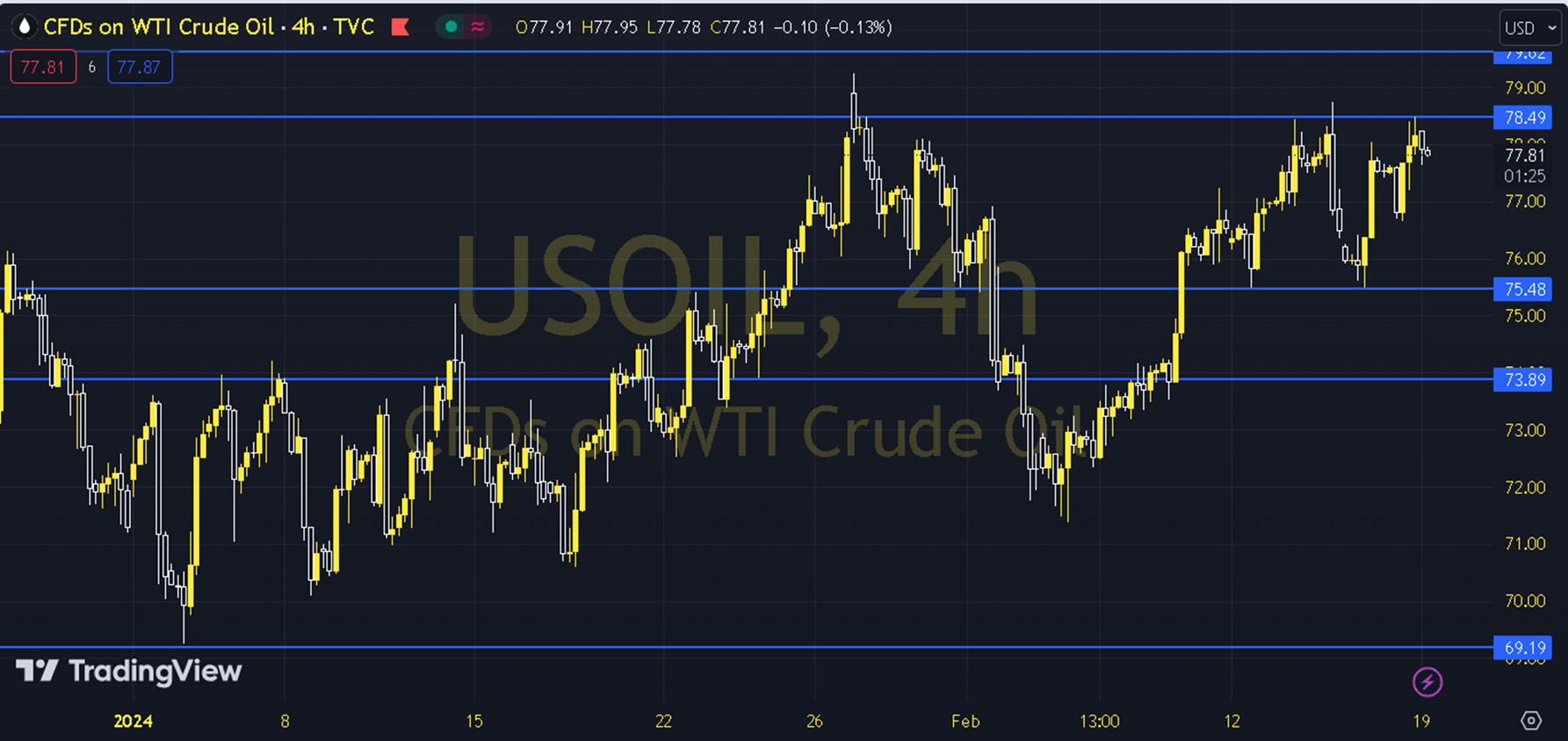

WTIUSD

The fact that concerns stemming from global demand, especially China, started the week with an increase pushed the geopolitical risk theme back a step. However, prices have not yet covered the path that would support downward expectations. Israeli attacks and the ongoing attacks of the Houthis in the Red Sea are limiting the price decline. In the upcoming period, as long as pricing remains at and above the 77.00 - 77.50 support, the upward outlook may be at the forefront. In possible increases, 78.50 and 79.00 levels may be targeted. As long as possible decreases are limited to the 77.00 - 77.50 support, new upward potential may occur. Therefore, it may be necessary to see the course below 77.00 and hourly closings for the continuation of the downward desire. In this case, 76.50 and 76.00 levels may come to the agenda. In the upcoming period, as long as pricing remains at and above the 77.00 - 77.50 support, the upward outlook may be at the forefront. Support: 77.00 Resistance: 78.50