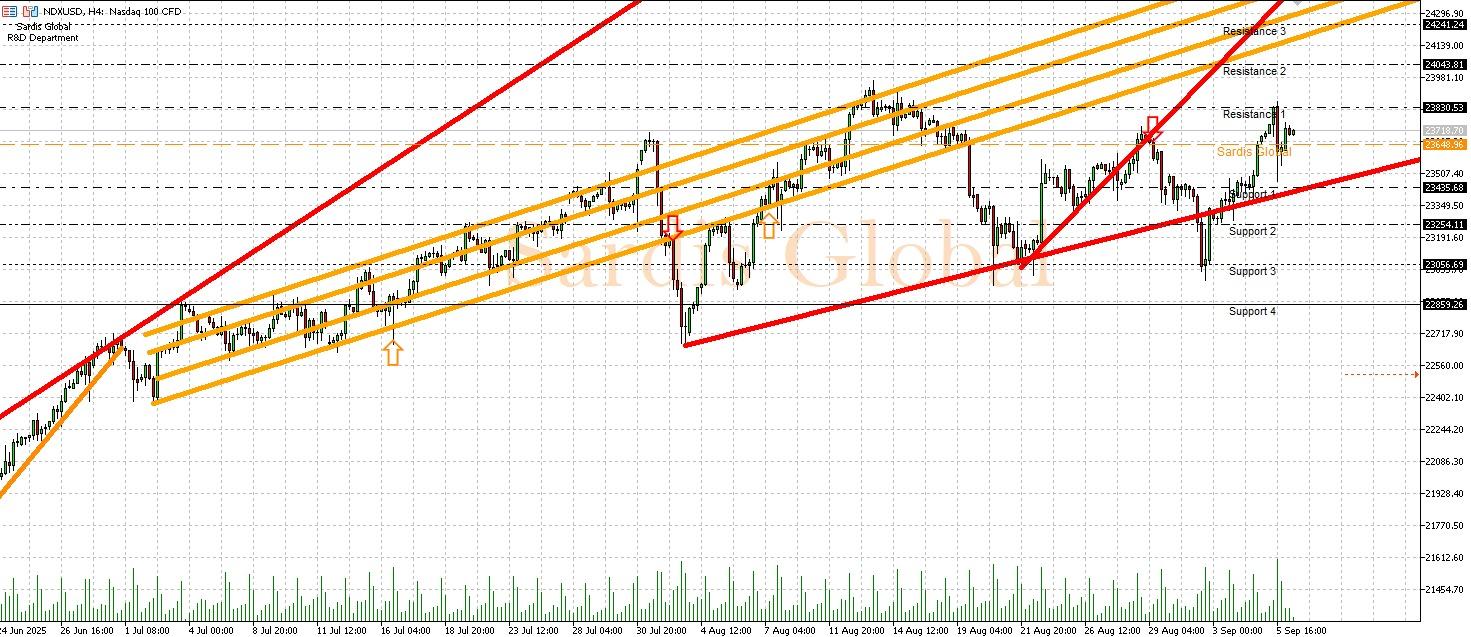

NDXUSD

The Nasdaq 100, which is sensitive to interest rates, started the week positively just above the pivot of 23648.96, hoping to see a slowdown in inflation data from the US. The fate of technology stocks this week depends on Wednesday's PPI and Thursday's CPI figures. A cooling in inflation would ease the Fed's stance and strengthen expectations that interest rate hikes have come to an end, thereby increasing interest in technology stocks. In this "risk-on" scenario, the index is expected to target the resistance at 23830.53, and if it rises above this level, it is anticipated to continue climbing towards 24043.81 and 24241.24. Conversely, if inflation remains hot and sticky, it would reignite concerns over interest rate hikes, leading to a sharp sell-off in technology stocks. In this case, it would not be surprising for the index to quickly retreat to the support level of 23435.68, and if broken, down to 23254.11.